Farm Organizations: New Federal Law Simplifies Payment Limitations

go.ncsu.edu/readext?1082374

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲The recent H.R. 1 budget reconciliation bill signed into law on July 3, 2025 made a number of changes to farm programs and qualifications that would normally be addressed in a five year farm bill. One of these is payment limitations on federal programs (e.g. conservation, crop insurance subsidies, disaster payments, etc.) imposed on farms organized as S corporations or limited liability companies (LLCs). The first payment limitation was introduced in 1970. Since that time, larger farms – those with multiple owners actively engaged in operations – required specialized structuring to allow their operating or landholding entity to capture more than one payment limitation to contribute to the overall operation.

It generally worked this way: LLCs and S corporations were treated as “individuals,” regardless of the number of members or shareholders, and could receive payments up to limitation. This was the case even though for federal income tax purposes, these entities are considered “pass through” entities where the individual equity owners pay or take their pro-rata share of tax liability (or loss). Partnerships and joint ventures on the other hand were considered pass through arrangements, so each partner could receive payments up to their individual limitation and apply to the business of the partnership or joint venture (i.e. the farm operation). One distinction is that such arrangements are not considered entities in that they do not require registration and formation under state law. As such, partnership arrangements are not considered legal individuals, shielding the equity owners from individual liability for actions of the partnership or other partners.

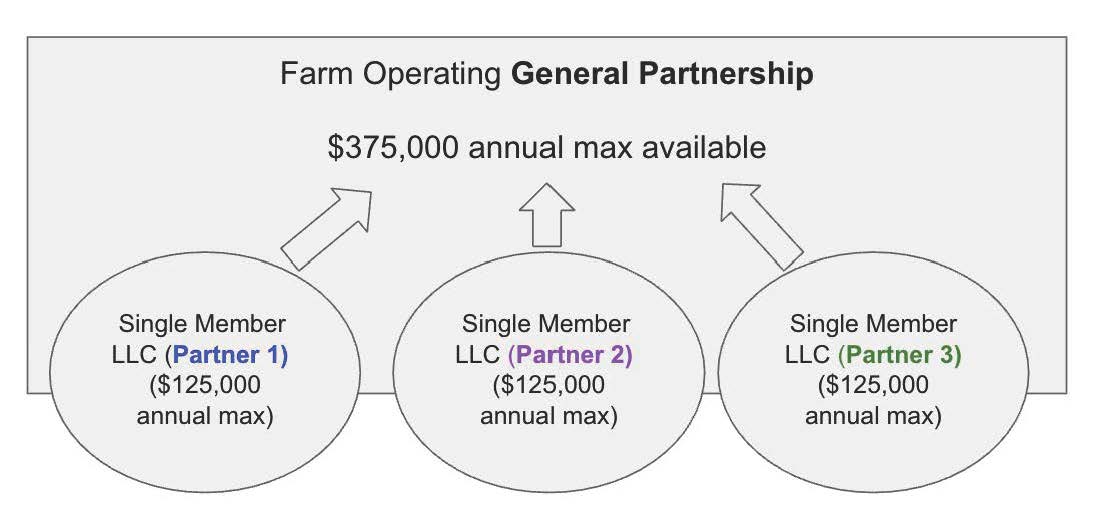

Such lack of liability protection made operating as a partnership risky to the individual partners, perhaps not worth the risk simply to attain multiple payment limitations. A workaround legal arrangement came into practice, whereby the farm firm would operate as a partnership, but the individual partners would organize single-member limited liability companies or S corporations and assign their interest to their LLC or corp, such that the LLC or corp became the partner, rather than them in their personal capacity. This had the theoretical effect of shielding their personal assets from any tort litigation liabilities of the partnership. The arrangement looked like this:

In this arrangement, instead of the farm being limited to one payment of $125,000, each individual LLC would qualify for a payment, so the farm operation could benefit from $375,000 in federal benefits (3 x $125,000).

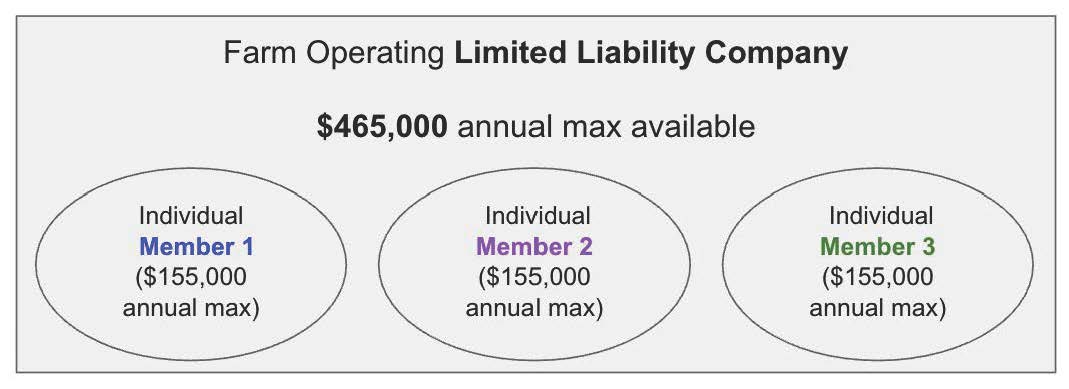

The HB1 provision now places LLCs and S corporations alongside partnerships and joint-ventures as pass-through entities for payment limitation purposes. Now, the farm may bypass the step of forming a partnership and organizing individual “partner entities,” and go straight to organizing the farm firm as one LLCs or S Corporation. Each individual partner or shareholder who is “actively engaged in farming” will have their own payment limitation, so the farm firm benefits from the individual limitation multiplied by the number of members (LLC) or shareholders (S Corp). The simplified arrangement may be formed as:

The limitation itself – previously set at $125,000 per individual – has been raised to $155,000 per individual. The Secretary of Agriculture is authorized to increase this amount yearly with inflation.

Whether farm firms will reorganize may be a matter of cost priority. The higher costs of the arrangement under the old rules came in the form of tax accounting for both the partnership and each individual partner entity, annual filing fees with the secretary of state, plus increased paperwork with the county Farm Service Agency office. For brand new set ups, reduced legal fees and state filing fees should offer savings.