Solar Development: NCSEA Releases Report on Property Tax Impact

go.ncsu.edu/readext?1080227

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

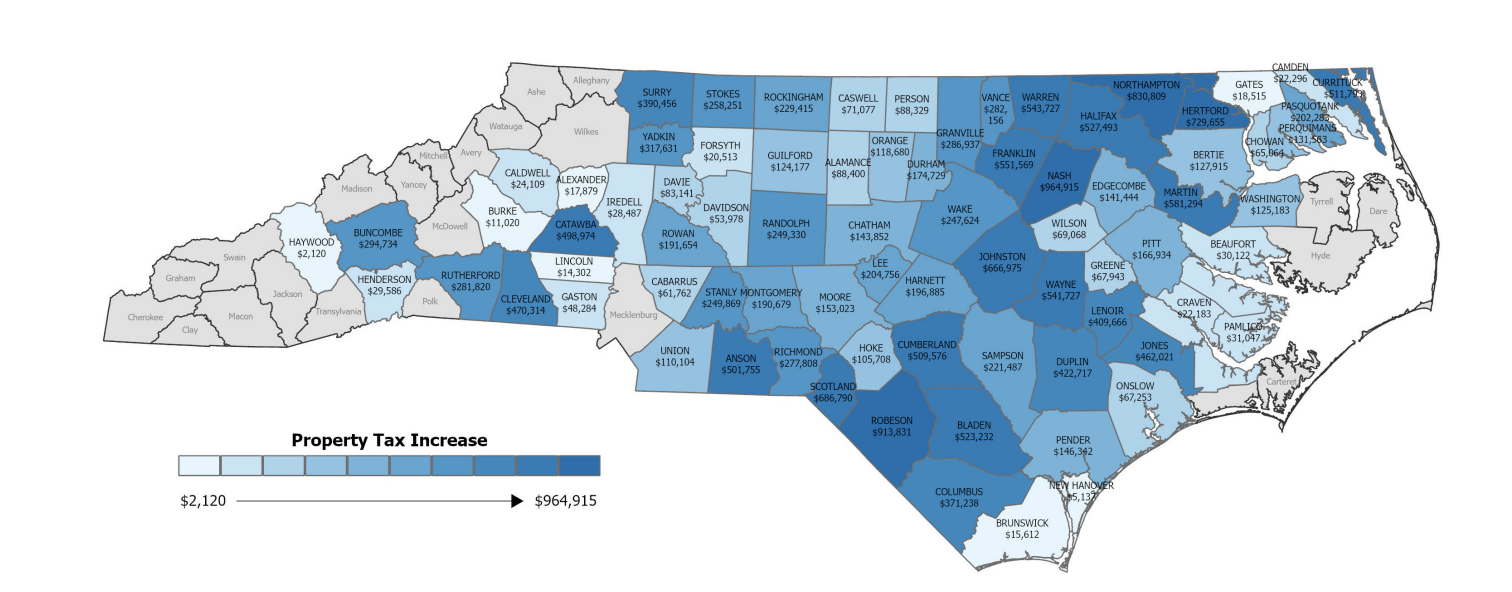

Collapse ▲This month the North Carolina Sustainable Energy Association (NCSEA) released a report on the property tax impact of utility-scale solar systems (USS) on county property tax revenue. The study of USS installed during the years 2022, 2023, and 2024 found an average $225,574 increase in county real and personal property tax revenue following installation of the USS. Of the counties studied, Nash and Northampton Counties had the highest increases of 3728% and 2498% respectively. Also profiled was that 54 turbine component of the vast Amazon facility located in Perquimmans County, which revealed an 193% increase in revenue.

The study used Geographic Information System (GIS) data from 78 counties to locate USS with 1MW or greater nameplate capacity, then researchers examined the tax records for those parcels, many of which were previously enrolled in county present use value programs where taxes are based on a use-value appraisal for agriculture or forestry use. Removal from the present use value (PUV) program allowed for collection of the three-year deferred taxes, known as the ‘roll back’. (Note: the report does not specify the number of parcels removed from PUV, which would be a good indicator on conversion of farm and forest use land for USS.)

(Note that the report does not mention any loss in sales tax revenue off-setting the gain property tax revenue. Such losses may be insignificant given the sales tax exemptions for purchases of farm and forest production inputs, and on products sold by their producer.)

Here again is a link to the study.

(cover image source: NCSEA)